Making a profit selling products is the foundation of any successful ecommerce business. But it isn’t always as simple as it sounds.

Let’s take a hypothetical sporting goods company. Let’s say it costs them $20 to produce a pair of ice skates. They can then price those ice skates high enough to make a profit.

But what if their competitor can produce a similar pair of ice skates for only $15. That competitor can then sell ice skates for less money, which likely means fewer people will buy the more expensive ice skates.

That’s why it’s critical for brands to know how much it costs to produce a single unit of a product but also why it’s important to track cost per unit and how it impacts their bottom lines.

Definition and Importance of Cost Per Unit

Cost per unit is a fundamental logistics KPI used in accounting and managerial economics that refers to the average cost incurred for each unit of product manufactured or service delivered. It is a crucial measure for businesses to determine their profitability and analytical capabilities. Informed businesses know how to calculate the cost per unit for each product or service offered to make informed pricing and marketing decisions.

The Role of Cost Per Unit in Business Operations

Cost per unit plays a crucial role in the day-to-day business operations. Understanding the cost per unit is essential to determine the optimal selling price, gross profit margins, and profitability metrics. Moreover, monitoring the cost per unit over time provides valuable insights into trends and allows for a real-time analysis of costs and revenue.

Additionally, the unit cost is influenced by multiple factors, such as fixed costs, variable costs, direct and indirect costs, production volume, and more.

Understanding the Components of Cost Per Unit

To understand the cost per unit formula, it is necessary to know its two components: fixed costs and variable costs.

Fixed Costs: Definition and Examples

Fixed costs are the expenses that remain constant regardless of the level of production or sales volume. Rent, insurance, salaries, and interest payments are examples of fixed costs. For example, if a company rents a warehouse, rent doesn’t go up or down if they produce 100 pairs of ice skates or 1,000.

Variable Costs: Definition and Examples

Variable costs, on the other hand, are expenses that change as production or sales increase. Direct materials, labor, and shipping costs are examples of fixed costs. A brand would need to buy more leather to produce 1,000 pairs of ice skates compared to 100 pairs of ice skates.

Breaking Down the Cost Per Unit Formula

Now that fixed cost and variable cost are explained, it’s time to look at how the unit cost is determined using these components. The cost per unit formula is simple: total production costs divided by the number of units produced.

Cost per Unit = Total Production Costs / Number of Units Produced

The total production cost is found by adding up the total fixed cost and the total variable cost. This formula can be utilized to find the cost per unit for any given product.

Practical Example of Cost Per Unit Calculation

Suppose a business produces 1,000 pairs of ice skates for a total production cost of $20,000. Dividing the total production cost by the number of units produced provides a cost per unit of $20 per unit.

The Difference Between Cost Per Unit and Price Per Unit

Cost per unit is different from price per unit, and understanding the difference is essential for calculating profitability.

Defining Price Per Unit

Price per unit refers to the price for which a brand sells its products or services, whereas cost per unit refers to the average expense incurred to produce a single unit of a product or service. Pricing reflects both the cost per unit and the profit margin, and setting the right price for finished goods and services is crucial to maintaining profitability.

The Relationship Between Cost Per Unit and Price Per Unit

Understanding the relationship between cost per unit and price per unit is essential for maximizing profitability. Businesses should set a price per unit based on the cost per unit and the desired profit margin. For example, if a brand can produce a pair of ice skates for $20 and wants a profit margin of 20%, they it would need to sell each pair of ice skates for at least $24.

How to Use Cost Per Unit for Better Business Decisions

Understanding cost per unit can help brands make better-informed decisions. Here are some ways cost per unit can assist with better decision-making:

Setting the Right Selling Price

By analyzing the cost per unit and gross margin, businesses can set the optimal selling price for each product they offer. A thorough understanding of the cost per unit can help determine how much businesses should charge for their products or services to enable efficient operations and maximize profits.

Evaluating Business Efficiency

Monitoring the cost per unit over time can help businesses evaluate their efficiency levels. This analysis is essential in identifying where cost savings can occur and monitoring the impact of efficiency improvements in business operations.

Strategies to Reduce Cost Per Unit

Optimizing cost per unit requires a proactive approach that involves implementing strategies to reduce costs without negatively impacting product quality. Here are some cost-reducing strategies businesses can leverage:

Optimizing Logistic Strategy

Streamlining logistics operations, reducing inventory holding costs, and minimizing time to market can all help reduce cost per unit. Streamlining logistics operations can help reduce cost per unit by reducing the amount of time and money it takes to get products from the manufacturer to the customer. Reducing inventory holding costs can be done by optimizing the inventory levels and selling off excess inventory.

Lowering Material Costs

By exploring alternative materials, reducing scrap and waste, and negotiating better pricing with their suppliers, brands can lower material costs and reduce cost per unit.

Reducing Overhead Costs

Overhead costs such as rent, utilities, and salaries can all be reduced by implementing efficient business management processes and proactive cost-cutting measures.

Minimizing Returns, Reshipments, and Dead Stock

Minimizing returns, reshipments, and dead stock can all help reduce cost per unit. Returns can be costly for businesses, as they often involve shipping the product back to the manufacturer or retailer, inspecting it, and then reselling it or destroying it. Reshipments can also be costly, as they involve shipping the product to the customer again after it was initially returned. Dead stock can be costly for businesses, as they have to pay for the cost of storing it, as well as the cost of eventually disposing of it.

The Role of Warehousing in Cost Per Unit

Efficient warehousing plays a critical role in reducing the cost per unit and streamlining logistics operations.

How Efficient Warehousing Can Lower Cost Per Unit

Effective inventory management techniques such as proper demand forecasting, Just-In-Time (JIT) inventory management, and RFID technology can all help lower the cost per unit. By maintaining inventory accuracy and accurately forecasting demand, brands can ensure that they have the right amount of inventory on hand to meet customer demand. RFID technology can be used to track inventory levels and movements in real time, which can help brands optimize their inventory levels and avoid stockouts.

The Impact of Warehousing on Fixed and Variable Costs

Effective warehousing can impact both fixed and variable costs. Reducing fixed costs such as rent and utilities can lower warehousing expense while optimizing logistics operations can decrease variable costs such as labor and material costs.

How Flowspace Can Help Reduce Your Cost Per Unit

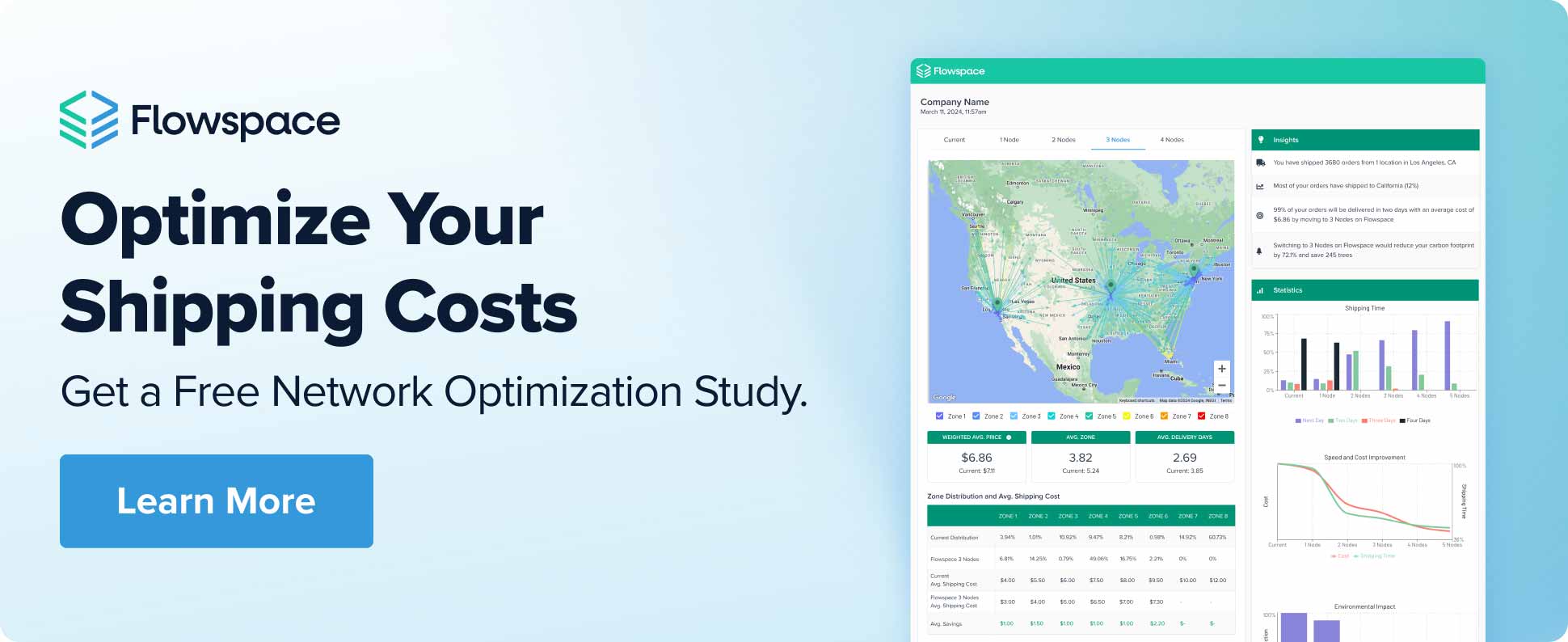

Partnering with a fulfillment company like Flowspace can help brands reduce their cost per unit. Flowspace’s solutions optimize logistics operations, offer inventory and order management capabilities, and utilize real-time technology to monitor fulfillment activity and inventory performance.

Flowspace’s order fulfillment platform effortlessly integrates with e-commerce platforms and various sales avenues, allowing brands to easily view stock quantities, handle products, and generate sales order insights in a snap.

Moreover, Flowspace offers an in-depth product inventory management system, granting brands full transparency over their stock. Brands can monitor their inventory in real-time, receive notifications when stock numbers dip, and extract valuable data to predict future product requirements. This empowers brands to maintain ideal stock quantities consistently, prevent low stock scenarios, and cut down on surplus inventory expenses.

Reach out now to discover how a fulfillment company such as Flowspace can assist you in refining your inventory control!