The 2022 holiday shopping season is set to be the biggest of all time for brands, retailers and shipping carriers alike. Sales and shipments are set to break records again, with $206.88 billion forecasted in ecommerce sales alone this year. Alongside an uptick in consumer demand comes an increase in sales and packages routed through major carriers and freight shipping companies, which can impact a brand’s profitability and bottom line if unprepared.

With more parcels than ever criss-crossing the United States, shipping carriers and, for the first time, Amazon, are implementing peak season surcharges and price increases to help them keep pace with increased demand and the additional handling costs that come with it. Structurally, carriers see seasonal surcharges as the new normal, and brands should expect and prepare for the added expense.

The best way to navigate holiday shipping costs and surcharges is to understand the surcharges and policies for each company and carrier so you’re not surprised at the end of the season. Smart brands will plan ahead to optimize shipments, and forecast for charges into Q1, as surcharges can trail seasonal billing.

Amazon

For the first time ever, Amazon will institute a holiday peak fulfillment fee on its fulfillment services for third-party sellers from October 15, 2022 to January 14, 2023.

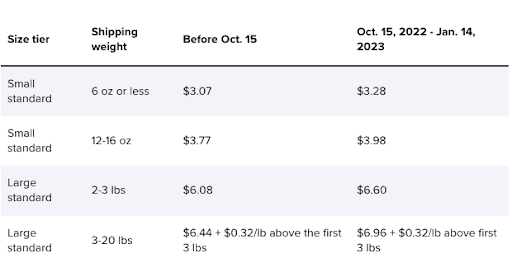

The holiday peak surcharge will cost an average of $0.35 per item sold through Fulfillment by Amazon (FBA) in the U.S. and Canada. Item size and weight will impact the fee as well, so the cost could rise. The company says the fee will cover “increased operating costs during the holiday peak period.”

This means that using Amazon fulfillment services instead of other carriers will no longer shield brands from added peak season shipping costs.

The new fee is the latest in a series of surcharges Amazon has instituted to pass on elevated operating costs to independent sellers reliant on FBA. The company raised FBA fees in January, and implemented a 5% fuel and inflation surcharge for FBA in April. The fuel and inflation surcharge applies to both peak and non-peak fulfillment fees.

Core FBA fulfillment fee charges, including the fuel and inflation surcharge, are as follows:

A comprehensive list of Amazon FBA fulfillment fee charges can be found here.

USPS

For the second year running, USPS will implement holiday price hikes due to the surge in ecommerce shopping.

The USPS will add surcharges to packages shipped between October 2, 2022 and January 22, 2023 to help offset higher shipping volumes and costs. The extra charges will apply to both commercial and retail domestic parcels, and shippers can expect to pay an additional 25¢ to $6.50 per shipment, depending on the size of the parcel and the distance it needs to travel. Notably, international shipments will be unaffected.

USPS rates that will apply to commercial Priority Mail and Priority Mail Express shipments are as follows:

- $0.75 increase for PM and PME Flat Rate Boxes and Envelopes

- $0.25 increase for Zones 1-4, 0-10 lbs.

- $0.80 increase for Zones 5-9, 0-10 lbs.

- $0.75 increase for Zones 1-4, 11-25 lbs.

- $2.80 increase for Zones 5-9, 11-25 lbs.

- $3.00 increase for Zones 1-4, 26-70 lbs.

- $6.50 increase for Zones 5-9, 26-70 lbs.

A full list of commercial and retail pricing and surcharges can be found on the Postal Service’s Postal Explorer website.

UPS

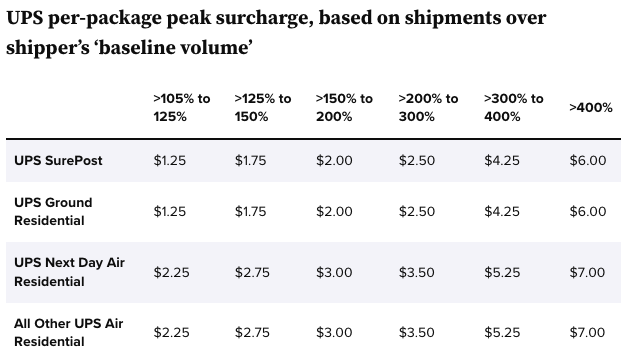

UPS peak season surcharges are targeted toward high-volume shippers and those experiencing spikes in consumer demand – a common occurrence for ecommerce brands around the holidays.

UPS’ “Peak/Demand Surcharge” will impact customers billed for more than 20,000 packages any week after October 2021, and will be applied on a weekly basis to all packages over 105% of the baseline volume for each service. “Baseline volume” is defined as the customer’s average weekly volume from June 5 through July 2 for the applicable shipping service. UPS will use the average weekly volume from Sept. 4 to Oct. 2 instead if it is less than 80% of the June-July period’s volume.Surcharges will be implemented from October 30, 2021 to January 14, 2023.

UPS is also raising its per-package surcharges for additional handling (from $3.50 to $6.50), large packages ($40 to $70) and packages in excess of its maximum shipping limits (no charge to $400) on qualifying customers. The new prices for these surcharges are active from Oct. 2, 2021 until Jan. 14, 2023.

A full list of UPS surcharges is here.

FedEx

FedEx implements a fluctuating surcharges structure. Peak season fees are activated in September and rise again beginning October 3, 2022.

FedEx will add surcharges for shipments and cargo that require additional handling, are oversized, or are unauthorized for its freight transportation network through January 15, 2023.

Peak additional handling surcharges on U.S. Express, U.S. Ground, and International Ground shipments will apply as follows:

- $3.45 per package from Sept. 5 – Oct. 2, 2022

- $6.55 per package from Oct. 3 – Jan. 15, 2022

Peak surcharges on FedEx Ground Economy Package Services include:

- $1.50 per package from Oct. 31 – Nov. 27, 2022

- $2.50 per package from Nov. 28 – Dec. 11 2022

- $1.50 per package from Dec. 12 – Jan. 15, 2023

Additional oversize and unauthorized charges include:

- $68.75 per package (Peak — Oversize Surcharge)

- $385 per package (Peak — Ground Unauthorized Package Charge)

Peak residential delivery charges will adjust dynamically each week, during “Calculation Week,” a period of time during which rates are determined for application two weeks later.

A comprehensive list of FedEx peak surcharges is available here.

How Flowspace Can Help

With operational and shipping costs rising across the industry, Flowspace can help brands optimize for the lowest possible peak season shipping costs by fulfilling products closer to end customers, reducing shipment distance and related costs.

Flowspace enables every merchant, from enterprise retail brand to medium and small business alike, to drive down last-mile delivery costs by decreasing the distance to a customer’s door. The award-winning Network Optimization model identifies optimal fulfillment centers closest to a brand’s customers, decreasing shipping distance and time, and Flowspace always works to select the optimal carrier and shipping option to decrease shipping costs on behalf of brands.

Brands have a huge opportunity to capture holiday spend ahead of them, and the time to prepare for peak is now. Whether you’re looking to decrease freight rates within your transportation network or simply hoping to maintain a positive holiday customer experience, Flowspace can help optimize your fulfillment for cost-savings.

Find out how Flowspace’s fulfillment and software solutions help you optimize for peak season and beyond. Get in touch today to learn more.